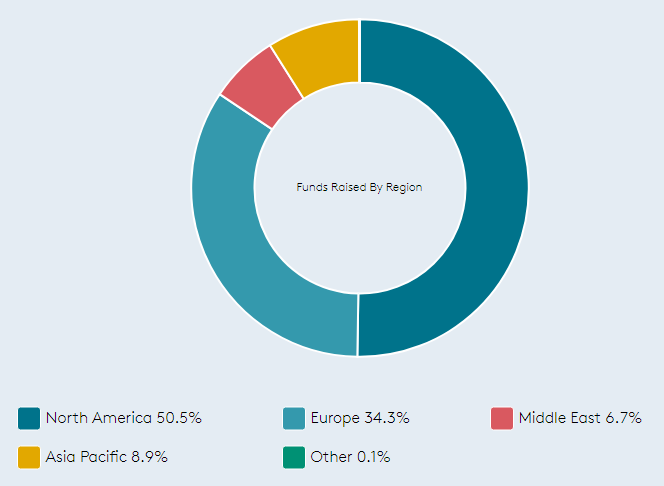

Primevest's European and Americas private equity strategy is focused on control or co-control investments in market-leading businesses across these regions. Typical enterprise values are between €500 million and €5 billion+.

Primevest maintains the most geographically diverse and long-established pan-regional office network of any private equity firm in Europe. 15 of Primevest's 24 offices are located in Europe and the Americas, providing a deep and local knowledge of the markets in which it operates. Using this platform, Primevest has sourced, acquired and divested companies in each of the major European geographies through multiple economic, industrial and market cycles.