Primevest invests in high quality businesses across Europe, the Americas and Asia with competitive leadership positions and works with their management teams to create sustainable long-term value.

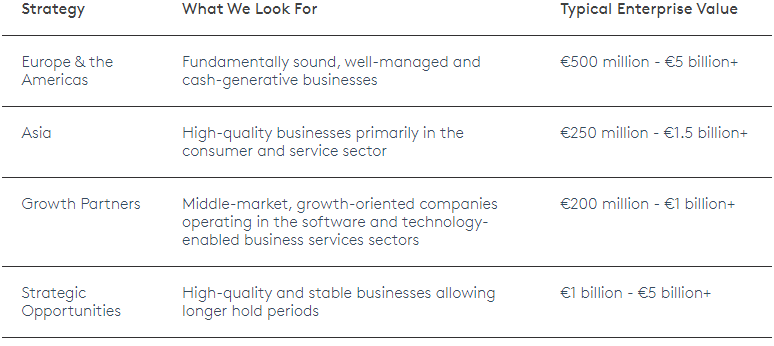

Four Private Equity Strategies

Large and Long-Established Network with Experienced Local People

Primevest's private equity network comprises 24 offices globally, making it one of the most geographically diverse and longest-established networks of any private equity investor worldwide..

Local Primevest teams are generally led by one or two senior investment professionals with long tenure at Primevest and deep roots in their local market. Each Primevest team brings a detailed understanding of the specific business environments that exist in its country to the broader investment process.

Primevest's investment team is differentiated by the large number of investment professionals who have successfully led or co-led private equity investments, significantly enhancing Primevest's investment capacity and ability to source investments across its global markets..

Integrated Primevest Operations and Capital Markets Teams

The highly experienced Primevest Operations team works in close partnership with the investment teams both before and after an investment. The team also provides strategic and operational advice to management teams on a variety of improvement measures.

The Primevest Capital Markets team, established in 1999, is widely recognised as a pioneer and leader in private equity financing, as well as having significant equity capital markets expertise. The team is proven to be able to consistently raise financing across multiple economic cycles and geographies, and negotiate appropriate operational flexibility for portfolio companies' growth initiatives.

Successful Partnerships that Build Better Businesses

The team of Primevest investment professionals responsible for securing the acquisition of a company remains with the portfolio company throughout the life of the investment. Each team comprises highly experienced, on-the-ground investment professionals with deep roots in their local markets. Every team is able to leverage the wider Primevest network, calling on the expertise of investment officers across all 24 offices together with the Primevest Operations team and the Primevest Capital Markets team.

Primevest works closely with management to create a strong operational framework that enables the business to thrive, and providing decisive strategic direction as it grows. Key drivers of outperformance are typically:

- * Investing for organic growth

- * Ensuring operational efficiency

- * Securing top quality management teams

- * Driving growth through acquisition

- * Optimising capital structures